Accelerating CRE’s Digital Shift With Risk Management & Insurance

Accelerating CRE’s Digital Transformation Through Risk Management And Insurance

Originally published on Bisnow.

Originally published on Bisnow.

Digital strategies are finally transforming commercial real estate. After decades of having a reputation for being slow to adopt technology, CRE enterprises are now empowering digital leaders and embracing proptech innovations. Across the board, CRE firms are re-envisioning everything from the tenant experience to operational effectiveness, all through the lens of digital and data-driven innovation.

This new adoption of digital strategies is not without its challenges.

“Ideation, workshops and pilots are easy,” said Jackson Slavik, former head of innovation and ventures for Starwood Properties. “Creating a tangible and sustaining business impact for demanding real-world stakeholders is hard.”

Slavik said that one part of the world where CRE owners are surprisingly successful in using digital strategies to deliver real impacts and return on investments is one of the most overlooked aspects of the industry: risk and insurance.

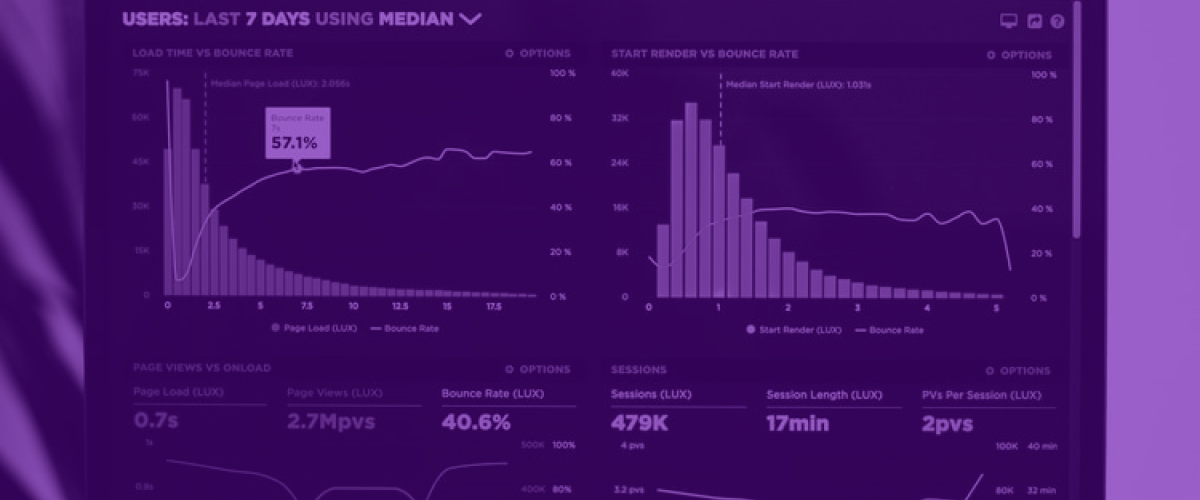

“Insurance and digital are two words not often seen in the same sentence, but for those looking to create a rapid digital impact, digitizing risk and insurance can serve as a powerful catalyst for a zero-to-one data science strategy,” Slavik said.

One thing driving commercial real estate companies to rethink their approaches to insurance is rising costs.

Insurance markets, driven by an increased volume of claims, catastrophic events and now Covid-related exposures, have been in a sustained hard market cycle, according to Hemant Shah, co-founder and CEO of Archipelago, a venture-backed proptech company, and former co-founder and CEO of RMS, the world’s leading catastrophe modeler serving the global insurance industry. Given the ever-increasing prospect of climate-related volatility, many across the CRE market are bracing for rising insurance costs for years to come.

While it may seem like many of these factors driving insurance costs are out of CRE owners’ control, owners have an underappreciated yet powerful lever to improve their insurance outcomes: their own data.

Insurers underwrite and price CRE risks using a variety of risk models and underwriting guidelines. These models require data as input, including detailed data property by property about the location, construction, protection, occupancies and exposures of each of the insured assets.

“Insurance underwriters are starving for trusted, detailed data about the construction and resiliency of these properties, their hazards and vulnerabilities, the risk management, property management and more,” Shah said. “Unfortunately, the data they receive from their customers, via their insurance brokers, on the properties is often incomplete, out of date and perceived to not be as accurate as they would like.”

He said that these impressions are compounded because this data is provided to underwriters via email, in spreadsheets and through unconnected documents and reports, making it difficult for the underwriters to efficiently review and understand the data.

In a recent survey by Archipelago, 90% of insurance underwriters reported a desire for more detailed information on their customers’ properties. A majority of the underwriters also responded that data quality can impact pricing by 20% or more. As one underwriter with a leading insurer put it, “lack of data forces us to assume the worst, resulting in more conservative pricing.”

Collecting high-quality data to drive better insurance outcomes is also a challenge for CRE risk management teams, Shah said.

New assets are continuously being acquired and divested, properties are maintained, retrofitted, repaired and enhanced. This means that throughout an asset’s life cycle, various stakeholders are observing, inspecting, recording and documenting crucial insights about the properties, including data useful for the risk and insurance underwriting process.

However, Shah said, there is significant source fragmentation to all this data, and much of the information is trapped in unstructured sources, such as documents, schematics and images.

Jeff Bray, senior vice president of global risk management for Prologis, knows these challenges all too well.

“Each insurance renewal was like Groundhog Day,” Bray said. “For years, we had been looking for a better way to connect and utilize all of our rich property and risk data.”

To transform this experience, Bray partnered with Archipelago to make it easier for insurers to see and validate their differentiation. The impact was immediate.

Slavik said that the Prologis experience isn’t unique, many of his former peers leading digital innovation in the commercial real estate sector are looking for ways to deliver tangible and immediate value to the business.

“I know of dozens of major CRE owners whose risk management teams now view insurance as a way to accelerate their firms’ digital strategies,” he said. “My advice to them is, increasingly, ‘To be effective, you need to create impact, quickly, and transforming your insurance process is a great way to demonstrate a digital win.’”

-------

Header image by Scott Graham on Unsplash

Share this

You May Also Like

These Related Stories

It’s Now Time for our Data to Catch-up

Risk Management 101: The Importance of Emergency Action Plans